GOOD MORNING!

FOREX

The Dollar Index and Euro are likely to test 100 and 1.15 respectively but thereafter will it reverse back to previous levels or see a breakout is uncertain. EURINR may rise towards 107/108 while above support near 105-105.50. EURJPY can trade within 180-185 region while USDJPY has almost reached to test 160. USDCNY needs to hold above 6.85 to rise further towards 6.90/95. Aussie and Pound are headed towards 0.71/72 and 1.35/36 respectively. The USDINR may trade within 92.00-92.50 region for the near term. Rupee weakness could be seen after a higher than expected CPI release yesterday.

Dollar Index (99.692) is lheaded towards the upper end of the 99.75-98.50 range mentioned yesterday. A break above 99.75 will pave way for 100-101 soon.

EURUSD (1.1518) has dipped to the lower end of the mentioned 1.15-1.17/1750 range. A break below 1.15, if seen would drag the price towards 1.1450-1.14 in the medium term. Watch price action at 1.15.

EURINR (106.3617) looks bullish towards 107/108 while above support at 105.50/105.

EURJPY (183.43) has immediate resistance at 185 below which we may expect trade within 183-185 to hold for a few sessions untill we see a breakout on either side of the range.

Dollar-Yen (159.22) has moved up as expected. A test of 160 is possible in the next few sessions.

USDCNY (6.8823) seems to be stable above 6.85. A slow rise to 6.90 and higher could be on the cards for the near term.

Aussie (0.7087) is likely to range within 0.69-0.72 for the near term.

Pound (1.3359) may trade within the 1.33-1.35/36 region for the near term.

USDINR (92.1950) closed above 92 yesterday. With the rise in the inflation for Feb-26 to 3.21%, the Rupee may continue to weaken in the near term. Upside targets of 92.30/50 remains intact for the coming sessions.

INTEREST RATES

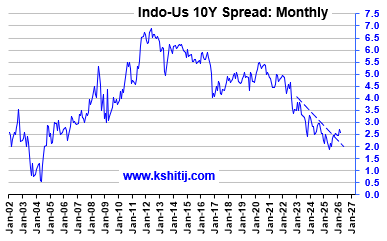

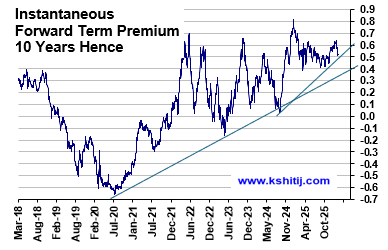

The US Treasury yields sustain higher. They have the potential to move further up from here. The US PCE data release today will need a close watch. A higher PCE number will aid the yields to go up. The German Yields are moving up in line with our expectation. They have room to rise further. The 10Yr GoI looks mixed and range bound now. The downside remains limited and the yield is likely to go higher eventually.

The US 10Yr (4.25%) and 30Yr (4.88%) Treasury yields are holding well above 4.2% and 4.85% respectively. That keeps the upside open to test 4.3% (10Yr) and 4.95% (30Yr).

The German 10Yr (2.95%) and 30Yr (3.52%) yields have risen further. The rise to 3% (10Yr) and 3.6% (30Yr) is happening in line with our expectation.

The 10Yr GoI (6.6666%) has risen back. The immediate picture is mixed and range bound. A test of 6.6% is still a possibility. But eventually the yield is likely to go up to 6.8%.

STOCKS

Global equities remain under pressure. The Dow continues to fall in line with expectations and can decline further towards 46500-46000. The DAX has bounced from recent lows but remains bearish while below 24000 with downside potential towards 23000-22000. Nifty also remains weak and can fall towards 23500-23000 in the coming weeks while it trades below 24000. Nikkei has slipped in line with expectations and may decline further towards 53000-52000. Shanghai remains relatively stable and may continue to move within the 4200-4050 range for some time.

Dow (46902, +0.39%) is falling in line with our expectations and can decline further towards 46500-46000 in the near term.

DAX (23632, +0.24%) has bounced back from yesterday's low of 23265. As long as it holds below 24000, our view remains bearish towards 23000-22000 in the near term.

Nifty (23,639.15, -0.95%) remains bearish towards 23500-23000 in the coming weeks while it trades below 24000.

Nikkei (53730, +0.05%) has fallen back in line with our expectations and a further decline towards 53000-52000 can be seen in the near term.

Shanghai (4129.80, +0.02%) has risen and can sustain within the 4200-4050 range for some time.

COMMODITIES

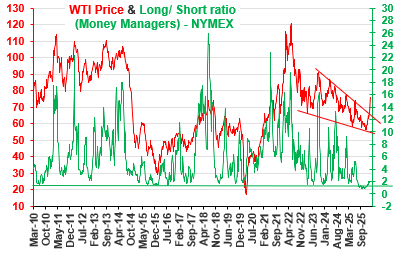

Crude prices remain strong due to heated geopolitical tensions. Brent rising above $100 and likely to move further towards $105-$110, while WTI can extend gains towards $98-$100 in the coming sessions. Precious metals have seen some pullback with Gold slipping but the broader view still points to a rise towards $5250-$5300. Silver may move higher towards $88-$92. Copper remains range bound and may continue to trade within $6.00-$5.60 until a clear breakout occurs. Natural Gas is gradually inching higher and can rise towards $3.50 in the near term.

Brent ($101.02) has risen above $100 in line with our expectations after UK Defence Secretary Healey said it is increasingly evident that Iran is laying mines in the Strait of Hormuz. A further rise towards $105-$110 can be seen in the coming sessions.

WTI ($96.40) has risen in line with our expectations and can rise further towards $98-$100 in the coming sessions.

Gold ($5,117.70) has fallen but the view remains intact for a rise towards $5250-$5300 in the near term.

Silver ($84.72) has fallen back but the view remains intact for a rise towards $88-$92 in the near term.

Copper ($5.8260) has fallen and can remain in a range of $6.00-$5.60 for some time until a breakout on either side provides clearer directional cues.

Natural Gas ($3.2510) is inching up gradually and can rise towards $3.50 in the near term.

DATA TODAY

GMT 6:00 IST 11:30 UK Trade Bal GBP (Bln)

...Expectations -22.1 ...Previous -22.7

GMT 10:00 IST 15:30 EU Ind Prodn (MoM)

...Expectations 0.5 ...Previous -1.4

GMT 12:30 IST 18:00 US Personal Income

...Kshitij 0.2 ...Expectations 0.4 ...Previous 0.3

GMT 12:30 IST 18:00 US PCE Price Index M/M

...Kshitij 0.3 ...Expectations 0.4 ...Previous 0.4

GMT 12:30 IST 18:00 US Core PCE

...Kshitij 0.3 ...Expectations 0.4 ...Previous 0.4

GMT 12:30 IST 18:00 US GDP

...Expectations 1.40 ...Previous 1.43

GMT 12:30 IST 18:00 US Durable Goods Orders

...Expectations 0.5 ...Previous -1.4

GMT 12:30 IST 18:00 CA Labour Force

...Expectations 11.1 ...Previous -24.8

DATA YESTERDAY

================

GMT 12:00 IST 17:30 IN CPI

...Kshitij 2.79 ...Previous 2.74 ...Actual 3.21

GMT 12:30 IST 18:00 US Housing Starts

...Kshitij 1327 ...Expectations 1340 ...Previous 1404 ...Actual

{GMT 12:30 IST 18:00 US Trade Balance

...Expectations -66.1 ...Previous -70.3 ...Actual

DISCLAIMER

These views/ forecasts/ suggestions, though proferred with the best of intentions, are based on our reading of the market at the time of writing. They are subject to change without notice.Though the information sources are believed to be reliable, the information is not guaranteed for accuracy. Those acting in the market on the basis of these are themselves responsible for any profits or losses that might occur, without recourse to us. World financial markets, and especially the Foreign Exchange markets, are inherently risky and it is assumed that those who trade these markets are fully aware of the risk of real loss involved.

WARNING !!

Visitors should be aware that Foreign Exchange transactions and trading are or can be subject to laws, rules and regulations of the country in which the entity undertaking the transactions is situated. It is incumbent upon the Visitors to keep themselves informed and abreast of the Laws they are (or would be expected to be) subject to and governed by, and act in accordance thereto.