Who is Using Kshitij?

Who is using Kshitij?

"Our company has substantial exposure to forex risk. KSHITIJ has a very structured operating procedure of hedging which they discuss with us in weekly FX Review meetings giving us a clear picture as to where we stand in our covers and exposures, which is very systematic. It gives us a lot of comfort in the forex aspect of the business. - P D Bagla, Jt. President, DCM Shriram Industries Ltd., New Delhi"

What's New?

Feb'26 Dollar-Rupee Forecast

Our February '26 Dollar Rupee Monthly Forecast is now available. To order a

PAID copy, please

click here and take a trial of our service.

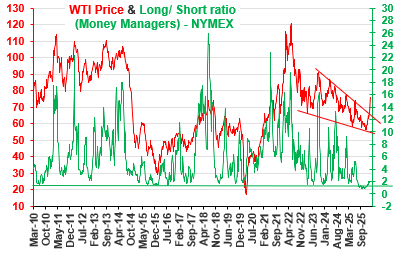

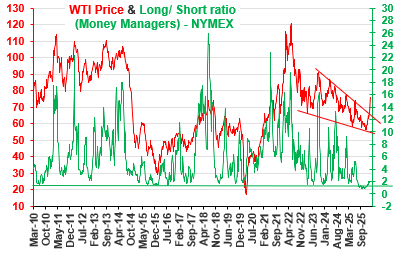

Mar'26 Crude Oil Forecast

The Net Long short position for WTI has started to move up. Currently above 2, will it rise sharply towards 4-6 and higher or fall back towards 1.5 or lower? The US-Iran conflict has lead to a sharp rally in crude prices. Will it dominate prices in the coming months? ...

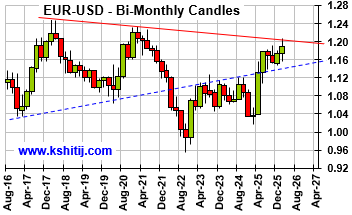

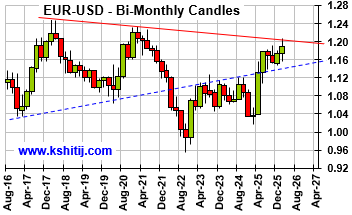

Click to ViewFeb'26 EURUSD Forecast

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? ...

Click to View

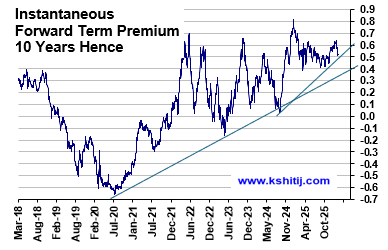

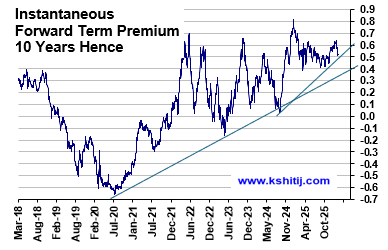

Mar'26 US Treasury Forecast

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with ...

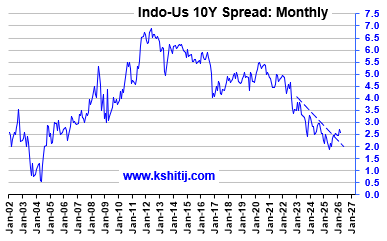

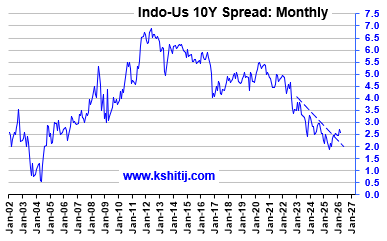

Click to ViewMar'26 GOI Forecast

The Real 10Yr Yield at 0.90% plus CPI at 6.2% implies that the nominal 10Yr GOI rate can ...

Click to ViewJan'26 USDJPY Forecast

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to ... ...

Click to View