GOOD MORNING!

FOREX

Continued escalation of war scenarios and missile strikes over the weekend and the possibility of a retaliatory strike from Iran on the UAE have ramped up crude prices which can pull up the US Dollar as well. Although the Dollar Index will not flare up like the oil prices but is likely to break above 100 to head towards upper resistance near 101-101.50 in the coming 1-2 weeks. Euro needs to break below 1.15 to target 1.14 or lower in the medium term. EURINR could be headed towards 105/104 while below 107.EURJPY could head towards 180 while below 183. USDJPY could soon test 160. While the Dollar Index rises, USDJPY would continue moving up. USDCNY has risen well as expected and could now test 6.95/97 soon. Aussie has dipped and can test 0.69; a break below 0.69 can trigger a fall to 0.68/67. Pound trades below 1.33 and can head towards 1.31/30 now. USDINR could again open with a gap up today. Having closed at 91.7450 on Friday, the pair can move above 92 today. It would be crucial to see if the RBI would come in to intervene else a rise to 92.50-92.75 could come into the picture for the coming days.

Dollar Index (99.581) trades higher today as the US-Iran war scenario continued over the weekend. While the conflict escalates, the Dollar Index could break above 100 and head towards interim resistance near 101-101.50 in the coming weeks.

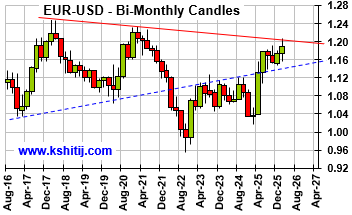

EURUSD (1.1516) has come down to the lower end of our expected range of 1.15-1.1750. A break below 1.15, if seen can trigger further decline towards 1.14 or lower in the medium term. Watch price action near 1.15.

EURINR (106.3169) can test 105-104 while below 107. Near term looks bearish. This is contrary to our earlier mentioned range of 106-108 in last week’s edition.

EURJPY (182.71) has scope to test 180 while below 183. Only a sustained rise past 183, if seen again will take it to 185 on the upside. However, a sustained bounce from 180 after an initial expected decline, will prove bullish for the cross pair. A break below 180, if seen can trigger medium term bearishness towards fresh lower targets.

Dollar-Yen (158.65) could soon test 160. The pair can continue to rise along with a rise in the Dollar Index.

USDCNY (6.9251) has risen well as expected. The pair can continue to rise towards 6.95/6.98 in the coming days.

Aussie (0.6966) can test 0.69 in the very near term, a break below which can take it further down towards 0.68/67 in the medium term. The fall can get accelerated on a stronger rally in the Dollar Index, if seen.

Pound (1.3286) has broken below 1.33 on a strong Dollar. A decline towards 1.31/30 is on the cards for the medium term.

USDINR (91.7450) is likely to again open with a gap up and trade above 92 today. NDF quotes 92.24 just now. It would be crucial to see if the RBI would again intervene and prevent a sharp rally. Else 92.50/92.75 would come into the picture for the coming sessions.

INTEREST RATES

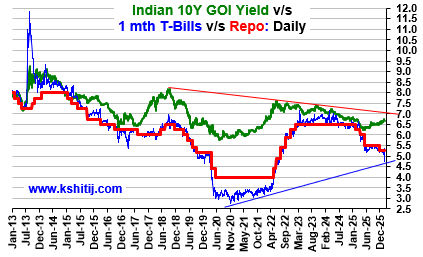

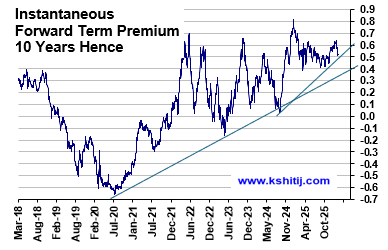

The US Treasury yields have come up to our expected levels. If the current momentum sustains, the yields can rise further from here. The German yields sustain higher. There is room to rise more from here. The 10Yr GoI has risen back above its support again. For now, it looks likely to be in a range. Bias is bullish to see a rise eventually.

The US 10Yr (4.19%) and 30Yr (4.80%) Treasury yields have come up to 4.2% (10Yr) and 4.8% (30Yr) as expected. If the momentum sustains, 4.3% (10Yr) and 4.9%-4.95% (30Yr) can be seen on the upside.

The German 10Yr (2.86%) and 30Yr (3.42%) yields sustain higher. The upside is open to see 2.9% (10Yr) and 3.5% (30Yr). The price action thereafter will need a watch.

The 10Yr GoI (6.6898%) has risen back well above 6.65%. There is a range of 6.64%-6.73% for now. The downside will be limited to 6.65%. Bias remains bullish to see 6.8% on the upside eventually.

STOCKS

Global equity markets have come under sharp pressure amid rising tensions in the Middle East and weak US economic data. Dow has broken below 47000 after softer NFP and higher unemployment and may fall towards 46000. DAX has also broken below 23000 and looks bearish towards 22500-22000. Nifty remains weak below 25000 with chances of a break below 24000 that could drag it towards 23800-23500. Nikkei has declined sharply and can extend the fall towards 50500-50000. Shanghai is holding near support at 4050 and may continue to move within the 4200-4050 range for some time.

Dow (46440, -2.27%) has broken below our mentioned level of 47000 due to higher US unemployment and weaker US NFP data. It has seen a low of 46398 so far and can decline further towards 46000.

DAX (22778, -3.27%) plummeted to a low of 23353 on Friday due to escalating tensions in the Middle East. Today it has broken below 23000 and is falling sharply. It looks further bearish towards 22500-22000 in the near term.

Nifty (24,450.45, -1.27%) remains weak below 25000 and with the ongoing tensions in the Middle East, the chances remain high for a break below 24000 and a fall towards 23800-23500 in the near term.

Nikkei (51810, -3.98%) has fallen well below our expected levels due to the ongoing tensions in the Middle East. It can remain bearish towards 50500-50000 in the near term.

Shanghai (4,053, -1.73%) has fallen to the lower end of the mentioned range. While support near 4050 holds, it can sustain within the 4200-4050 range for some time.

COMMODITIES

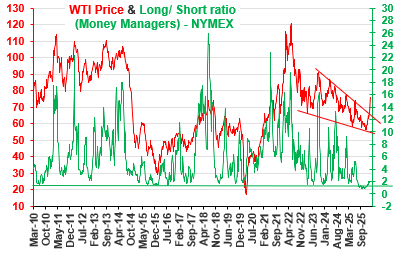

Crude prices have surged sharply amid escalating tensions in the Middle East and the closure of the Strait of Hormuz, pushing both Brent and WTI above $100 with further upside towards $115-$120 possible in the near term. Gold is falling off but remains supported above $5000, keeping the broader bullish outlook intact for a rise towards $5200-$5300. Silver has dipped slightly but continues to hold its positive outlook for a rise towards $84-$86. Copper has declined in line with expectations and may fall further towards $5.6-$5.5 in the coming sessions. Natural Gas has rebounded strongly and can extend its rise towards $3.5-$3.6 in the near term.

Brent ($109.71) has surged past $100 due to the ongoing tensions in the Middle East and the closure of the Strait of Hormuz, which has disrupted crude supply. The price can remain bullish towards $115-$120 in the near term.

WTI ($109.83) has surged above $100 and tested a high of $111.24 so far amid the ongoing tensions in the Middle East. The price can remain volatile and move further higher towards $115-$120 in the near term.

Gold ($5,080.70) is falling but remains above the immediate support near $5000. As long as this support holds, we retain our view of a rise towards $5200-$5300 in the near term.

Silver ($80.83) has fallen, but the outlook remains intact for a rise towards $84-$86 in the near term.

Copper ($5.6920) has dipped in line with our expectations and can decline further towards $5.6-$5.5 in the coming sessions.

Natural Gas ($3.4330) has bounced back sharply and opened higher at $3.30 today. A further rise towards $3.5-$3.6 can be seen in the near term.

DATA TODAY

GMT 1:30 IST 07:00 CN CPI (YoY)

...Previous 0.2

GMT 1:30 IST 07:00 CN PPI

...Previous -1.4

DATA LAST FRIDAY

================

GMT 10:00 IST 15:30 EU GDP

...Expectations 0.3 ...Previous 0.3 ...Actual 0.2

GMT 13:30 IST 19:00 US NFP

...Kshtij 14 ...Expectations 58 ...Previous 130 ...Actual

GMT 13:30 IST 19:00 US Unemployment Rate

...Expectations 4.3 ...Previous 4.3 ...Actual

GMT 13:30 IST 19:00 US Avg Hrly Earnings

...Kshtij 0.4 ...Expectations 0.3 ...Previous 0.3 ...Actual

GMT 13:30 IST 19:00 US Average Hourly Earnings Production & Non Supervisory Employees

...Previous 0.4 ...Actual

DISCLAIMER

These views/ forecasts/ suggestions, though proferred with the best of intentions, are based on our reading of the market at the time of writing. They are subject to change without notice.Though the information sources are believed to be reliable, the information is not guaranteed for accuracy. Those acting in the market on the basis of these are themselves responsible for any profits or losses that might occur, without recourse to us. World financial markets, and especially the Foreign Exchange markets, are inherently risky and it is assumed that those who trade these markets are fully aware of the risk of real loss involved.

WARNING !!

Visitors should be aware that Foreign Exchange transactions and trading are or can be subject to laws, rules and regulations of the country in which the entity undertaking the transactions is situated. It is incumbent upon the Visitors to keep themselves informed and abreast of the Laws they are (or would be expected to be) subject to and governed by, and act in accordance thereto.